TSX Venture Exchange: ADY

OTC: ADYRF

FSE: 701GR

PORT MORESBY, Papua New Guinea , May 13, 2024 /CNW/ – Adyton Resources Corporation (TSX.V: ADY) (“Company”) is pleased to announce that it has entered into a binding Investment and Development Agreement (“IDA”) with East Vision International Holdings PTE Ltd (“EVIH”) effective May 13, 2024 for the development of its Fergusson Island Gold Project (the “Project”). Pursuant to the terms of the agreement, EVIH has the right to acquire up to a 50% ownership interest in the Project through a total investment of up to US$9.5 million , with US$8.5 million to fund Project expenditures and US$1.0 million to be paid to the Company, of which US$500,000 was paid to the Company upon execution of the IDA.

Managing Director Tim Crossley said, “This is a terrific outcome for Adyton, the people of Milne Bay and particularly the people of Fergusson Island . This agreement has no impact on the capital structure of Adyton or the ownership of our flagship Feni Island project which hosts a substantial gold resource with significant additional copper and gold prospectivity, while providing a full financing pathway for the Fergusson Island Project to development and cash flow with Adyton retaining a 50% economic interest. Furthermore, EVIH has deep mining pedigree though their Sichuan province mining business and have also demonstrated project execution experience in PNG through their recently constructed Edevu Hydro power station project. We are excited to work with EVIH, local landowners, the Provincial Government, MRA and CEPA to progress the Fergusson Island Gold Projectto being shovel ready.”

Tim Crossley continued, “The Fergusson Island projects are advanced exploration projects with Wapulo developed as a mine in 1994 and then later closed due to low gold prices. The larger and higher grade Gameta resource is likely to be the focus of first production, however, with the projects being only 30km apart, they are most likely to be progressed concurrently with the tenements connected by a proposed road. With funding now secured, feasibility work will commence in earnest.”

EVIH Chairman Mr. Lou said, “We are greatly looking forward to working with Adyton on the Fergusson Island Gold Project and believe our company can bring significant value to the projects through low-cost operations and advanced processing expertise and we are ready to immediately deploy our resources to Fergusson Island .”

The Fergusson Island Project

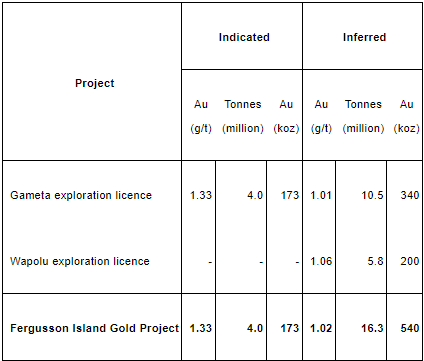

The Project comprises the Wapolu and Gameta advanced Exploration Licenses on Fergusson Island in Papua New Guinea for which the Company has previously reported the following mineral resource estimate:

Gameta and Wapolu resources at 0.5g/t gold cut-off 1

Under the terms of the IDA, EVIH has the right to acquire up to a 50% ownership interest in the Project through a total investment of up to US$9.5 million , with US$1.0 million to be paid to the Company and US$8.5 million to fund expenditures for the construction of an experimental production line, completion of a project feasibility study and other activities required to obtain all necessary licenses, consents and approvals to construct a minimum 2 million ton ROM gold concentrate mining and processing operation at the Project within 2.5 years from the effective date of the IDA (“Initial Investment Amount”). US$500,000 of the amount to be paid to the Company was received on execution of the IDA.

Should the Initial Investment Amount of US$8.5 million be insufficient to conclude all necessary activities as described above, EVIH may provide a shareholder loan to MRE capped at USD$2 million to complete the activities.

EVIH will earn its 50% interest in the Project by acquiring an ownership interest in the Company’s subsidiary MR Exploration PNG Pte Ltd (“MRE”). MRE is the 100% legal owner of the Company’s Papua New Guinea subsidiaries that are the registered holders of the Gameta and Wapolu Exploration Licences. EVIH will acquire its ownership interest in MRE in the following manner:

|

i. |

MRE will issue 103,365,385 Class B Shares to EVIH. The Class B Shares have no voting rights and do not participate in dividends or other distributions by MRE. |

|

ii. |

The Class B Shares will convert into Class A Shares of MRE, which have voting rights and participate in dividends and other distributions, on a 1-for-1 basis on the achievement of the following milestones (“Initial Investment Milestones”) within 2.5 years from the effective date of the IDA: |

|

(a) |

20% of the Class B Shares will convert into Class A Shares at the time that all necessary statutory and landowner approvals required to execute and complete the experimental production line, including bulk sampling pit, metallurgical trials and quantitative testing of the Project, inclusive of all required, permits, consents, approvals, equipment and infrastructure to enable the experimental/bulk sample to be operated in a safe and professional manner, are obtained; |

|

(b) |

30% of the Class B Shares will convert into Class A Shares on the completion of the project feasibility study for a minimum 2 million ton ROM gold concentrate mining and processing operation for the Project; and |

|

(c) |

50% of the Class B Shares will convert into MRE Class A Shares on the grant of a mining lease, environmental permit and any other licenses, permits or approvals required for the development of the minimum 2 million ton ROM gold concentrate mining and processing operation at the Project. |

Should each of the Initial Investment Milestones be satisfied, all of the Class B Shares issued to EVIH will convert to Class A Shares, and each of the Company and EVIH will hold 50% of the issued Class A Shares with 50% of the voting rights and rights to participate in dividends and other distributions.

__________________________________________________

|

1 See the technical report entitled “NI 43-101 Technical Report on the Fergusson Gold Property, Milne Bay Province, Papua New Guinea” dated October 14, 2022 and prepared for the Company in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) by Mark Berry (MAIG), Simon Tear (MIGI PGeo), Matthew White (MAIG) and Andy Thomas (MAIG), each an independent mining consultant and “qualified person” as defined in NI 43-101, available under the Company’s profile on SEDAR+ at www.sedarplus.ca. Mineral resources are not mineral reserves and have not demonstrated economic viability. |

On the satisfaction of all of the Initial Investment Milestones and MRE determining to proceed with the development of the Project, EVIH and the Company have agreed to use reasonable endeavours to negotiate and enter into a project funding and development agreement reflecting the following terms:

|

i. |

EVIH will finance the development of the Project through a loan provided by EVIH to MRE, at an interest rate of 8% per annum (“EVIH PFA Loan”). The required funding amount will be determined by the project feasibility study. |

|

ii. |

EVIH will be reimbursed for the EVIH PFA Loan amount and accrued interest thereon through a preferential cash sweep of 90% of the free cash flow from the Project until the EVIH PFA Loan amount and accrued interest thereon have been repaid. |

If EVIH does not provide the required project funding for the development of the Project, its ownership interest in MRE will be reduced to 10% through the issue of additional Class A Shares to the Company.

In addition to the Initial Investment Amount and the EVIH PFA Loan amount referred to above, EVIH is required to pay the Company an additional amount of US$500,000 within 90 days of the issuance of a bulk sampling permit and the construction of the experimental production line for the Project.

The transaction is an arm’s length transaction and qualifies as an Exempt Transaction under the policies of the TSX Venture Exchange. The Company is not paying any finder fees in connection with the transaction.

ON BEHALF OF THE BOARD OF ADYTON RESOURCES CORPORATION

Tim Crossley , Chief Executive Officer

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this press release.

Adyton Resources Corporation is focused on the development of gold and copper resources in world class mineral jurisdictions. It currently has a portfolio of highly prospective mineral exploration projects in Papua New Guinea on which it is exploring to expand its identified gold Inferred and Indicated Mineral Resources and expand on its recent significant copper drill intercepts on the 100% owned Feni Island project. The Company’s mineral exploration projects are located on the Pacific Ring of Fire on easy to access island locations which hosts several globally significant copper and gold deposits including the Lihir gold mine and Panguna copper/gold mine on Bougainville Island, both neighboring projects to the Company’s Feni Island project.

Adyton has a total declared Resource inventory (disclosed in accordance with NI 43-101) within its PNG portfolio of projects of 2,175,000 ounces gold.

Adyton is also quoted on the OTC under the code ADYRF and on the Frankfurt Stock Exchange under the code 701:GR .

For more information about Adyton and its projects, visit www.adytonresources.com

The scientific and technical information contained in this press release has been prepared, reviewed, and approved by Rod Watt, BSc Hons (Geo), FAusIMM, Chief Geologist of Adyton, who is a “Qualified Person” as defined by National Instrument 43‐ 101 ‐ Standards of Disclosure for Mineral Projects. Mr. Watt consents to the inclusion of his name in this release.

This press release includes “forward‐looking statements”, including forecasts, estimates, expectations, and objectives for future operations that are subject to several assumptions, risks, and uncertainties, many of which are beyond the control of Adyton. Forward‐ looking statements and information can generally be identified by the use of forward‐looking terminology such as “may”, “will”, “should”, “expect”, “intend”, “estimate”, “anticipate”, “believe”, “continue”, “plans” or similar terminology. Forward looking statements in this news release include all statements with respect to the funding of the Initial Investment Amount, the completion of the Initial Investment Milestones and the funding and development of the Project. The forward‐looking information contained herein is provided for the purpose of assisting readers in understanding management’s current expectations and plans relating to the future. Readers are cautioned that such information may not be appropriate for other purposes. Forward‐looking information are based on management of the parties’ reasonable assumptions, estimates, expectations, analyses and opinions, which are based on such management’s experience and perception of trends, current conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances, but which may prove to be incorrect. Such factors, among other things, include: impacts arising from the global disruption caused by the Covid‐19 coronavirus outbreak, changes in general macroeconomic conditions; changes in securities markets; changes in the price of gold or certain other commodities; change in national and local government, legislation, taxation, controls, regulations and political or economic developments; risks and hazards associated with the business of mineral exploration, development and mining (including environmental hazards, industrial accidents, unusual or unexpected formations pressures, cave‐ins and flooding); discrepancies between actual and estimated metallurgical recoveries; inability to obtain adequate insurance to cover risks and hazards; the presence of laws and regulations that may impose restrictions on mining; employee relations; relationships with and claims by local communities and indigenous populations; availability of and changes in the costs associated with mining inputs and labour; the speculative nature of mineral exploration and development (including the risks of obtaining necessary licenses, permits and approvals from government authorities); and title to properties. Investors are cautioned that any such statements are not guarantees of future performance and that actual results or developments may differ materially from those projected in the forward‐looking statements. Such forward‐looking information represents management’s best judgment based on information currently available. No forward‐looking statement can be guaranteed, and actual future results may vary materially. Readers are cautioned not to place undue reliance on forward looking statements or information. Adyton Resources Corporation undertakes no obligation to update forward‐looking information except as required by applicable law.