Port Moresby, Papua New Guinea–(Newsfile Corp. – March 20, 2025) – Adyton Resources Corporation (TSXV: ADY) (“Adyton” or the “Company“) is pleased to announce that it has now been drilling for over a week on its 100% owned Feni Island Gold-Copper Project in PNG. Two core drilling rigs have been deployed, with plans to operate both rigs continuously on day and night shifts. Adyton contracted Zenex drilling from Lihir to undertake the program, targeting to drill up to 8000 m.

HIGHLIGHTS

- Two core drilling rigs in production at Feni Island Gold-Copper Project

- This drill program targeted to grow the MRE to >2.5 Moz Au, and target a pathway to 5 Moz Exploration Target.

- “The striking similarities between the geological setting and mineralisation style at Lihir and Feni suggest a high exploration potential of the latter where the mineralisation is concealed by young volcanic cover.”

“This is a significant milestone and following on from the commencement of drilling on our Fergusson Island project in December 2024 funded via our JV demonstrates Adytons ability to advance our on-the-ground activities in PNG in an efficient and effective way,” stated Tim Crossley, Chief Executive Officer. “Commencement of an approximately 8000 m diamond drill program is a significant milestone being the first time Adyton has drilled on Feni since its successful 2021 program.”

As noted by world renowned Geologist Dr Daniel Müller in a recent review of Adytons work on Feni Island, “The striking similarities between the geological setting and mineralisation style at Lihir and Feni suggest a high exploration potential of the latter where the mineralisation is concealed by young volcanic cover.” “Suffice to say that given the geological similarities to Lihir and the Island Chains prolific history of Tier 1 discoveries, we are very confident that as a result of this drill campaign, Adyton will be able to significantly expand on its existing foundation MRE of 1.46 Moz and demonstrate that Feni supports a large scale, expandable and rich mineral system.”

“In being able to deliver this milestone to commence drilling again at Feni I would like to acknowledge the hard work of our COO Dr Chris Bowden, his team of PNG national geologists, and most importantly, the people of Feni Island who have provided unwavering support to Adyton.”

Chris Bowden, Adyton COO, also commented: “It is great to see the drill rigs turning at Feni, and knowing that this drilling program will be able to systematically test the Kabang mineralised system, and deliver high-confidence outcomes. The geology across Feni Project is highly prospective, and the initial drilling at Kabang is only just scratching the surface for the whole islands’ gold-copper mineralization potential. This program is targeted to grow the MRE to > 2.5 M ounces and demonstrate a pathway to achieve our initial exploration target of 5 M ounces.”

Figure 1: Barge Landing in Nanum Bay Feni Island with drill rigs and associated support equipment

Figure 3: Drill Rig D11 set up on the second hole, FDD002.

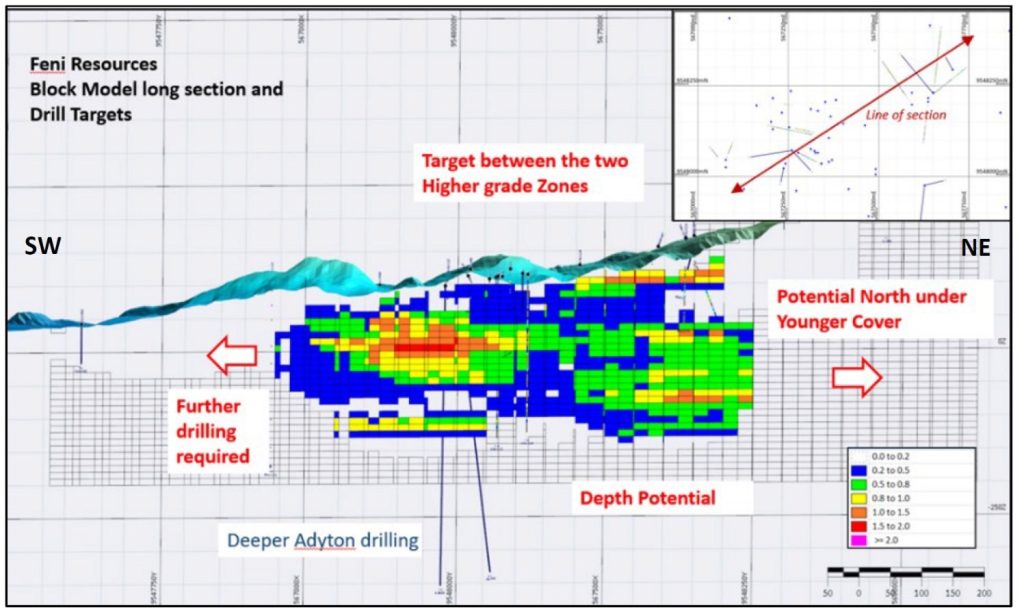

Figure 4: Long Section through the existing Kabang MRE (derisk 2021). The current inferred mineral resource estimate is open in all directions and represents only a small part of the larger Kabang target area. Drilling to target depth and northeast extension under drilled post mineral cover.

This drill program is primarily focused on the extension of the Kabang Resource at depth and in a northeast direction along the mineral corridor which has not been historically drilled and sits under approximately 50-100 m of post mineral cover (see Figure 4). Some twinning of historical holes will be required particularly where copper assays were not performed. Deeper holes of 450m and up to 600m will be used to test depth extension where the following historic holes ended in grade:

| AMD002: 250 m to end of hole, entire hole mineralized | |

| AMD004: ends in gold and copper mineralization | |

| AMD005: ends in copper mineralization | |

| AMD006: end in gold mineralization | |

| AMD007: ends in gold mineralization | |

| KAD002: ends in gold mineralization | |

| MAD001: ends in gold mineralization, no copper assays | |

| MAD005: ends in gold and copper mineralization | |

| MAD009: ends in gold mineralization |

On the completion of this program it is expected that copper will also be reported in a newly informed MRE.

Geological Background

Lihir Island is part of the Tabar to Feni island chain located in the former fore-arc basin of the New Ireland arc system in the Bismarck Archipelago, NW Papua New Guinea (Fig. 1). Cessation of SW-directed subduction of the Pacific plate due to clogging of the subduction zone by the buoyant Ontong-Java plateau in the middle Tertiary led to plate rotation and a shift from compressional to extensional regimes (Coleman and Kroenke, 1981). As a consequence, calc-alkaline subduction-related magmatism within the New Ireland arc ceased and back-arc rifting commenced in the Manus basin around 3.5 Ma ago due to NE-directed subduction of the Solomon Sea microplate. Due to the curvature of the New Britain trench, narrow, vertically extensive slab tears developed, which propagate beneath Lihir and Feni islands (Holm and Richards, 2013; Lindley et al., 2016).

Rift-related trans-crustal extensional structures initiated adiabatic decompression melting of the mantle underlying the New Ireland forearc basin and generated alkaline magmatism that produced the Tabar, Lihir, Tanga, and Feni Islands (Müller et al., 2001) as well as numerous submarine volcanoes such as Conical Seamount (Brandl et al., 2020). Volcanic activity in the Tabar-Lihir-Tanga-Feni island chain (Fig. 2) started on Simberi Island (Tabar island group) in the New Ireland fore arc region (Rytuba et al., 1993) and most recent on-land eruption is recorded on Feni Island dated at about 2300 years ago (Licence et al., 1987).

Similar to Lihir, Feni Island was formed by alkaline magmatism with distinctly high oxygen fugacities (Müller et al., 2001; Schirra et al., 2024). Whereas Lihir is composed of five stratovolcanoes, Feni Island consists of one single stratovolcano that is emplaced by a younger maar-type diatreme (Fig. 3). The composition of the alkaline rocks that make up both islands is very similar with distinctly low HFSE contents (Zr<110, Hf<3 ppm) reflecting their derivation in an island arc-setting. Overall, the alkaline magmas that formed Feni Island are slightly more evolved than those from Lihir. Limited drilling at Feni intersects hydrothermally altered trachyandesites, monzodiorites, monzonites and, more rarely, syenite intrusions as well as late-stage dacite dykes. Syenite intrusions have not been recorded at Lihir, but in places, there are trachybasalts reflecting their slightly more mafic compositions (Müller et al., 2001).

For further information please contact:

Tim Crossley, Chief Executive Officer

E‐mail: ir@adtyonresources.com

Phone: +61 7 3854 2389

Phone: +1 778 549 6768

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this press release.

ABOUT ADYTON RESOURCES CORPORATION

Adyton Resources Corporation is focused on the development of gold and copper resources in world class mineral jurisdictions. It currently has a portfolio of highly prospective mineral exploration projects in Papua New Guinea on which it is exploring to expand its identified gold Inferred and Indicated Mineral Resources and expand on its recent significant copper drill intercepts on the 100% owned Feni Island project. The Company’s mineral exploration projects are located on the Pacific Ring of Fire on easy to access island locations which hosts several globally significant copper and gold deposits including the Lihir gold mine and Panguna copper/gold mine on Bougainville Island, both neighboring projects to the Company’s Feni Island project.

Adyton has a total Mineral Resource Estimate inventory within its PNG portfolio of projects comprising indicated resources of 173,000 ounces gold and inferred resources of 2,000,000 ounces gold.

The Feni Island Project currently has a mineral resource prepared in accordance with NI 43-101 dated October 14, 2021, which has outlined an initial inferred mineral resource of 60.4 million tonnes at an average grade of 0.75 g/t Au, for contained gold of 1,460,000 ounces, assuming a cut-off grade of 0.5 g/t Au. See the NI 43-101 technical report entitled “NI 43-101 Technical Report on the Feni Gold-Copper Property, New Ireland Province, Papua New Guinea prepared for Adyton Resources by Mark Berry (MAIG), Simon Tear (MIGI PGeo), Matthew White (MAIG) and Andy Thomas (MAIG), each an independent mining consultant and “qualified person” as defined in NI 43-101,available under Adyton’s profile on SEDAR+ at www.sedarplus.ca. Mineral resources are not mineral reserves and have not demonstrated economic viability.

The Fergusson Island Project currently has a mineral resource prepared in accordance with NI 43-101 dated October 14, 2021, which outlined an indicated mineral resource of 4.0 million tonnes at an average grade of 1.33 g/t Au for contained gold of 173,000 ounces and an inferred mineral resource of 16.3 million tonnes at an average grade of 1.02 g/t Au for contained gold of 540,000 ounces. See the technical report entitled “NI 43-101 Technical Report on the Fergusson Gold Property, Milne Bay Province, Papua New Guinea” prepared for Adyton Resources by Mark Berry (MAIG), Simon Tear (MIGI PGeo), Matthew White (MAIG) and Andy Thomas (MAIG), each an independent mining consultant and “qualified person” as defined in NI 43-101,available under the Company’s profile on SEDAR+ at www.sedarplus.ca. Mineral resources are not mineral reserves and have not demonstrated economic viability.

Adyton is also quoted on the Frankfurt Stock Exchange under the code 701:GR.

Qualified Person

The scientific and technical information contained in this press release has been prepared, reviewed, and approved by Dr Chris Wilson BSc (Hons), PhD, FAusIMM (CP), FSEG, FGS, the Chief Geologist and a Director of Adyton, who is a “Qualified Person” as defined by National Instrument 43‐101 ‐ Standards of Disclosure for Mineral Projects.

Forward looking statements

This press release includes “forward‐looking statements”, including forecasts, estimates, expectations, and objectives for future operations that are subject to several assumptions, risks, and uncertainties, many of which are beyond the control of Adyton. Forward‐ looking statements and information can generally be identified by the use of forward‐looking terminology such as “may”, “will”, “should”, “expect”, “intend”, “estimate”, “anticipate”, “believe”, “continue”, “plans” or similar terminology. Forward looking statements in this news release include plans pertaining to the drill program, the intention to prepare additional technical studies, the timing of the drill program, uses of the recent drone survey data, the timing of updating key findings, the preparation of resource estimates, and the deeper exploration of high-grade gold and copper feeder systems . The forward‐looking information contained herein is provided for the purpose of assisting readers in understanding management’s current expectations and plans relating to the future. Readers are cautioned that such information may not be appropriate for other purposes.

Forward‐looking information are based on management of the parties’ reasonable assumptions, estimates, expectations, analyses, and opinions, which are based on such management’s experience and perception of trends, current conditions and expected developments, the receipt of any necessary permits, licenses and regulatory approvals in connection with the future development of the projects in a timely manner; the availability of financing on suitable terms for the development; construction and continued operation of the Fergusson Island Project and the Feni Island Project; the ability to effectively complete the drilling program; and Adyton’s ability to comply with all applicable regulations and laws, including environmental, health and safety laws.

Investors are cautioned that forward-looking statements are not based on historical facts but instead reflect Adyton’s management’s expectations, estimates or projections concerning future results or events based on the opinions, assumptions and estimates of managements considered reasonable at the date the statements are made. Although Adyton believes that the expectations reflected in such forward- looking statements are reasonable, such information involves risks and uncertainties, and under reliance should not be placed on such information, as unknown or unpredictable factors could have material adverse effects on future results, performance or achievements expressed or implied by Adyton. Among the key risk factors that could cause actual results to differ materially from those projected in the forward- looking statements are the following: impacts arising from the global disruption, changes in general macroeconomic conditions; reliance on key personnel; reliance on Zenex Drilling; changes in securities markets; changes in the price of gold or certain other commodities; change in national and local government, legislation, taxation, controls, regulations and political or economic developments; risks and hazards associated with the business of mineral exploration, development and mining (including environmental hazards, industrial accidents, unusual or unexpected formations pressures, cave‐ins and flooding); discrepancies between actual and estimated metallurgical recoveries; inability to obtain adequate insurance to cover risks and hazards; the presence of laws and regulations that may impose restrictions on mining; employee relations; relationships with and claims by local communities and indigenous populations; availability of and changes in the costs associated with mining inputs and labour; the speculative nature of mineral exploration and development (including the risks of obtaining necessary licenses, permits and approvals from government authorities); and title to properties. Investors are cautioned that any such statements are not guarantees of future performance and that actual results or developments may differ materially from those projected in the forward‐looking statements. Such forward‐looking information represents management’s best judgment based on information currently available. No forward‐looking statement can be guaranteed, and actual future results may vary materially. Readers are cautioned not to place undue reliance on forward looking statements or information. Adyton Resources Corporation undertakes no obligation to update forward‐looking information except as required by applicable law.