Brisbane, Australia – December 10, 2025 – Adyton Resources Corporation (TSX Venture: ADY) (“Adyton” or the “Company”) is pleased to announce that it has received a Non-Binding LOI from Korean group Hyosung TNC Corporation on December 8, 2025 for the purchase of gold concentrate from its Wapolu Gold Project in Papua New Guinea.

Highlights:

- Strong demand interest from concentrate traders: Adyton has attracted strong interest from global trading houses for concentrate from its Wapolu project, which is targeted to restart production in late 2026;

- Payable terms significantly improved: Adyton’s discussions with a range of traders indicate that payable terms for concentrates with the expected Wapolu specifications have materially improved, with an anticipated 15% improvement from terms previously provided and used in Adyton’s internal modelling;

- Significant project value uplift expected: Supported by a strong gold price environment, Adyton expects that should the improved payability terms be reflected in final sale and purchase agreements, there will be a significant and material enhancement to the value of the Wapolu and Gameta projects on Fergusson Island.

Tim Crossley, Chief Executive Officer, commented:

“This LOI is a very positive indicator for our Fergusson Island projects, highlighting robust demand for precious-metal concentrates. The material improvement in payable terms combined with the current strength in gold prices positions our Fergusson projects to generate strong cash flows.”

Gary Wang, Chief Executive Officer, EVIH, stated:

“This indicative concentrate pricing is very positive for our Fergusson Island projects and, combined with the strong gold price, provides us with strong motivation to accelerate all aspects of project permitting and development.”

Project Update

Adyton, together with its joint venture (JV) partner EVIH, is advancing the Wapolu project with a targeted production restart in late 2026. Current work streams are focusing on completing all precursor inputs to the submission of the Mining Lease (ML) application and the Conservation and Environment Protection Authority (CEPA) permit.

Background

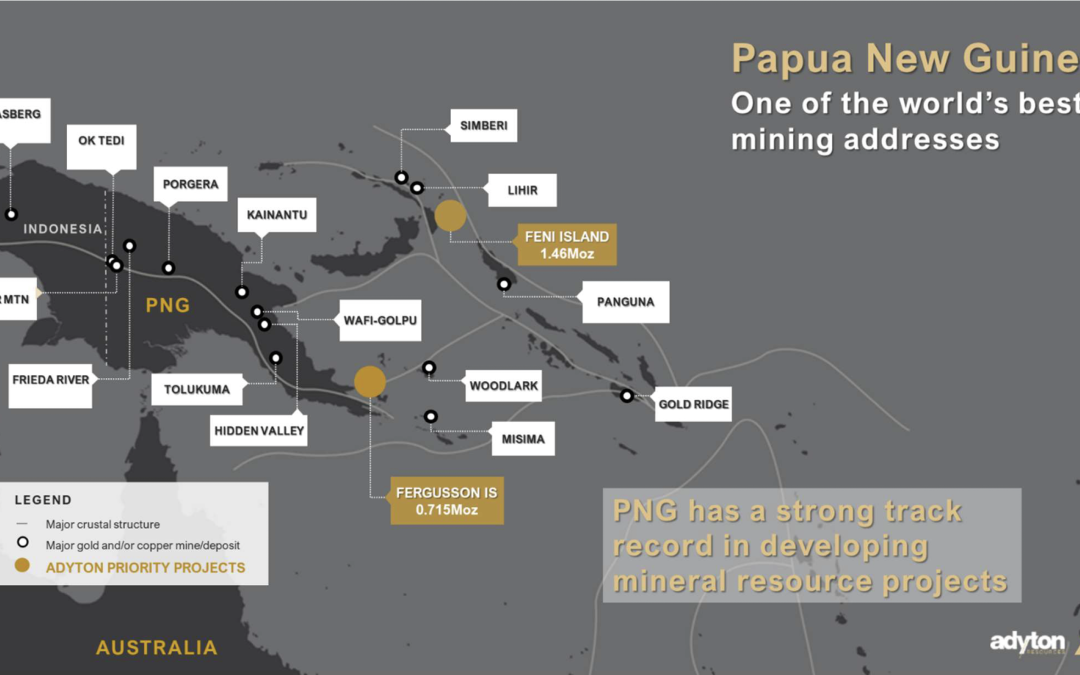

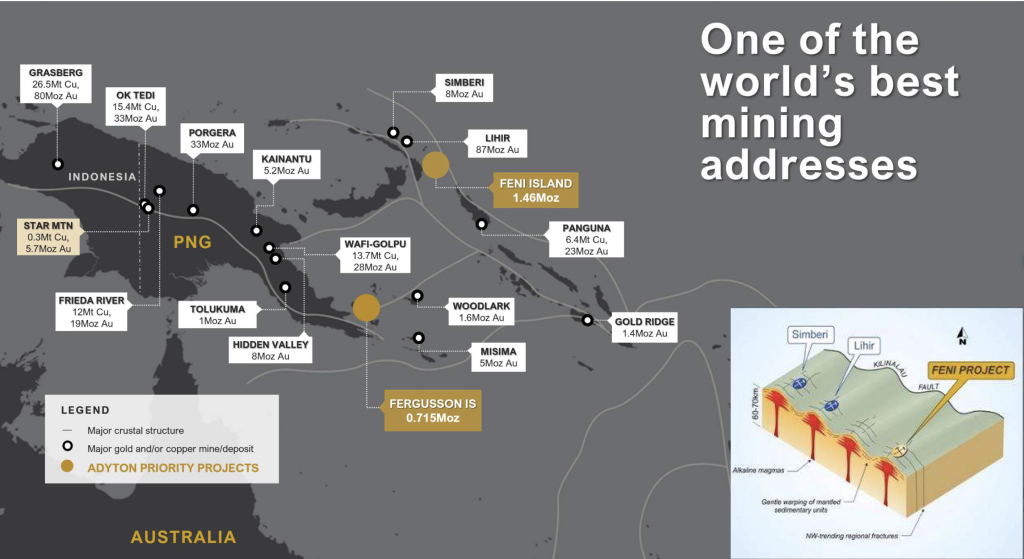

Adyton’s gold projects, held in JV with EVIH, are located on easily accessible islands in Papua New Guinea (PNG). The Gameta and Wapolu projects are situated on Fergusson Island in the Milne Bay province of PNG, which also hosts the Woodlark and Misima projects (refer to map of PNG deposits at the end of this document).

Figure 1: Fergusson Island Projects

The Wapolu gold project (refer to Figure 1) is a proposed restart of the past-producing Wapolu mine which operated in the mid 1990’s, producing about 9,000oz of gold before shutting down due to low gold prices. The restart of Wapolu will be substantially easier than a green field project, being enabled by significant existing infrastructure such as airstrips, workshop and warehouse structures, basic wharf infrastructure and tailings impoundments.

The neighboring Gameta project is an advanced exploration asset being prepared to be taken into permitting and development, that lies approximately 30 km from Wapolu and has the benefit of being able to leverage some of the Wapolu infrastructure, such as the airstrip.

Resource Estimate

The existing Gameta and Wapolu Mineral Resource Estimate is highlighted in Table 1, with resources open at depth and along strike. The current drill programs at both Wapolu and Gameta are in part designed to test depth and strike extensions but also importantly to increase resource confidence to enable progression to establish reserve estimates and the Mining License (ML) application.

1. See the technical report entitled “NI 43-101 Technical Report on the Fergusson Gold Property, Milne Bay Province, Papua New Guinea” dated October 14, 2022 and prepared for the Company in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) by Mark Berry (MAIG), Simon Tear (MIGI PGeo), Matthew White (MAIG) and Andy Thomas (MAIG), each an independent

For further information please contact:

Tim Crossley, Chief Executive Officer

E‐mail: ir@adytonresources.com

Phone: +61 7 3854 2389

Phone: +1 778 549 6768

ABOUT ADYTON RESOURCES CORPORATION

Adyton Resources Corporation is focused on the development of gold and copper resources in world class mineral jurisdictions. It currently has a portfolio of highly prospective mineral exploration projects in Papua New Guinea on which it is exploring to expand its identified gold Inferred and Indicated Mineral Resources and expand on its recent significant copper drill intercepts on the 100% owned Feni Island project. The Company’s mineral exploration projects are located on the Pacific Ring of Fire on easy to access island locations which hosts several globally significant copper and gold deposits including the Lihir gold mine and Panguna copper/gold mine on Bougainville Island, both neighboring projects to the Company’s Feni Island project.

Adyton has a total Mineral Resource Estimate inventory within its PNG portfolio of projects comprising indicated resources of 173,000 ounces gold and inferred resources of 2,000,000 ounces gold.

The Feni Island Project currently has a mineral resource prepared in accordance with NI 43-101 dated October 14, 2021, which has outlined an initial inferred mineral resource of 60.4 million tonnes at an average grade of 0.75 g/t Au, for contained gold of 1,460,000 ounces, assuming a cut-off grade of 0.5 g/t Au. See the NI 43-101 technical report entitled “NI 43-101 Technical Report on the Feni Gold-Copper Property, New Ireland Province, Papua New Guinea prepared for Adyton Resources by Mark Berry (MAIG), Simon Tear (MIGI PGeo), Matthew White (MAIG) and Andy Thomas (MAIG), each an independent mining consultant and “qualified person” as defined in NI 43-101, available under Adyton’s profile on SEDAR+ at www.sedarplus.ca. Mineral resources are not mineral reserves and have not demonstrated economic viability.

The Fergusson Island Project currently has a mineral resource prepared in accordance with NI 43-101 dated October 14, 2021, which outlined an indicated mineral resource of 4.0 million tonnes at an average grade of 1.33 g/t Au for contained gold of 173,000 ounces and an inferred mineral resource of 16.3 million tonnes at an average grade of 1.02 g/t Au for contained gold of 540,000 ounces. See the technical report entitled “NI 43-101 Technical Report on the Fergusson Gold Property, Milne Bay Province, Papua New Guinea” prepared for Adyton Resources by Mark Berry (MAIG), Simon Tear (MIGI PGeo), Matthew White (MAIG) and Andy Thomas (MAIG), each an independent mining consultant and “qualified person” as defined in NI 43-101, available under the Company’s profile on SEDAR+ at www.sedarplus.ca. Mineral resources are not mineral reserves and have not demonstrated economic viability.

For more information about Adyton and its projects, visit www.adytonresources.com

x

x

Forward looking statements

This press release contains certain forward-looking statements as well as historical information. Readers should not rely on information in this summary for any purpose other than for gaining general knowledge of the Company. Forward-looking statements include, but are not limited to, the completion and the closing of the Offering and use of proceeds raised in the Offering and Non-Brokered Offering. The words “expected”, “will” and similar expressions are intended to be among the statements that identify forward-looking statements. Although the Company believes that its expectations as reflected in any forward-looking statements, are reasonable, such statements involve risks and uncertainties and no assurance can be given that actual results will be consistent with these forward- looking statements. Except as required by law, the Company undertakes no obligation to update these forward-looking statements in the event that management’s beliefs, estimates, opinions or other factors should change.

This press release does not constitute an offer to buy or sell securities in the United States. The distribution of Adyton securities in connection with the Offerings and Non-Brokered Offering described herein will not be registered under the United States Securities Act of 1933 (the “U.S. Securities Act”) and Adyton securities may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements of the U.S. Securities Act and applicable state securities laws. This press release shall not constitute an offer to sell or the solicitation of an offer to buy Adyton securities, nor shall there be any offer or sale of Adyton securities in any jurisdiction in which such offer, solicitation or sale would be unlawful.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.